$25,000

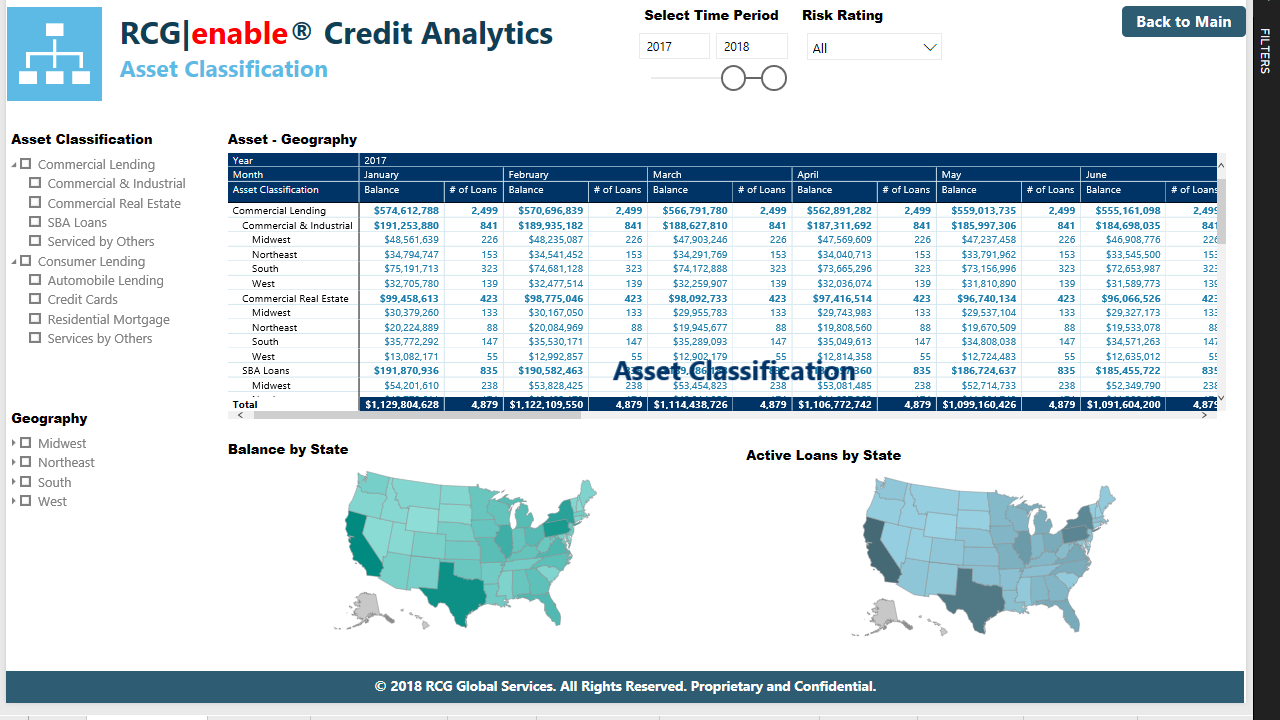

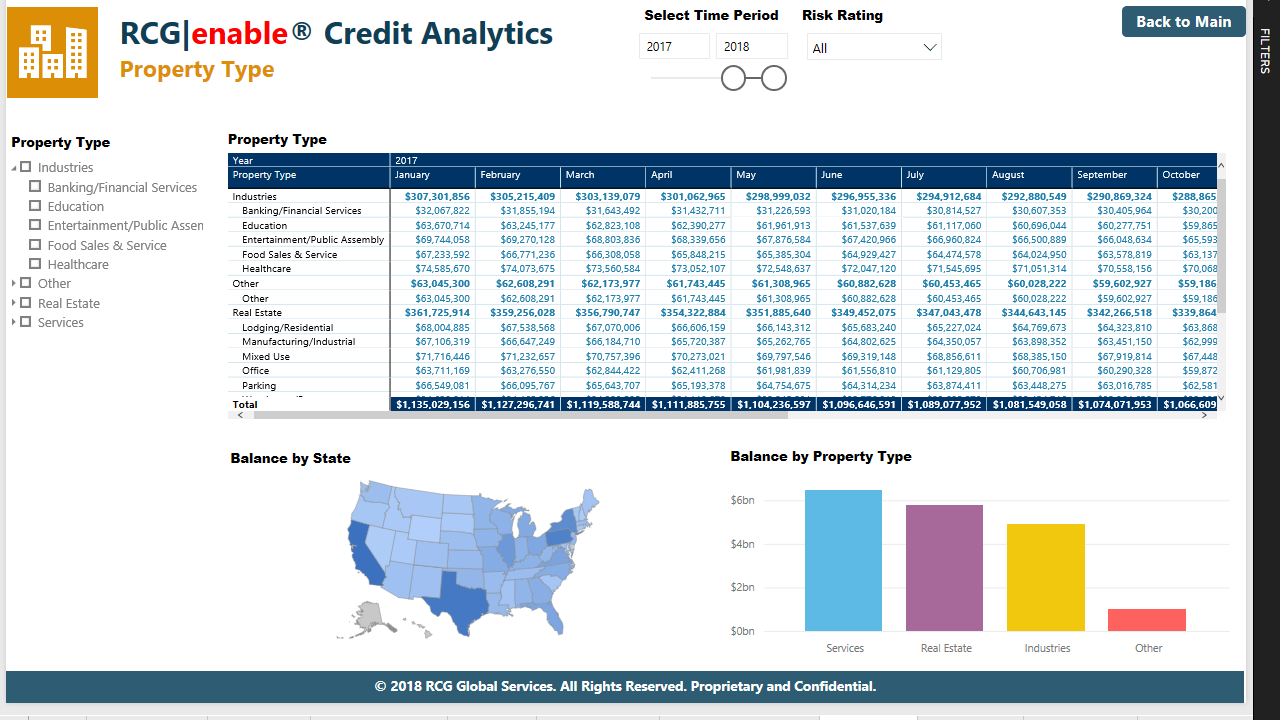

A Loan Portfolio Analytics solution used to manage risk, maximize risk-adjusted rate of return, minimize capital reserve requirements, and strengthen compliance

OVERVIEW

This 30-day trial offer allows you to use your loan data to experience RCG’s solution. It provides you the ability to assess your full loan portfolio using our secure, flexible, and expandable solution and technologies and includes quick-start support from RCG.

INDUSTRY / BUSINESS USERS

Banking / Risk or financial analysts who support a Chief Financial Officer, Chief Risk Officer, Chief Compliance Officer or Compliance Manager, or a Loan SVP or VP

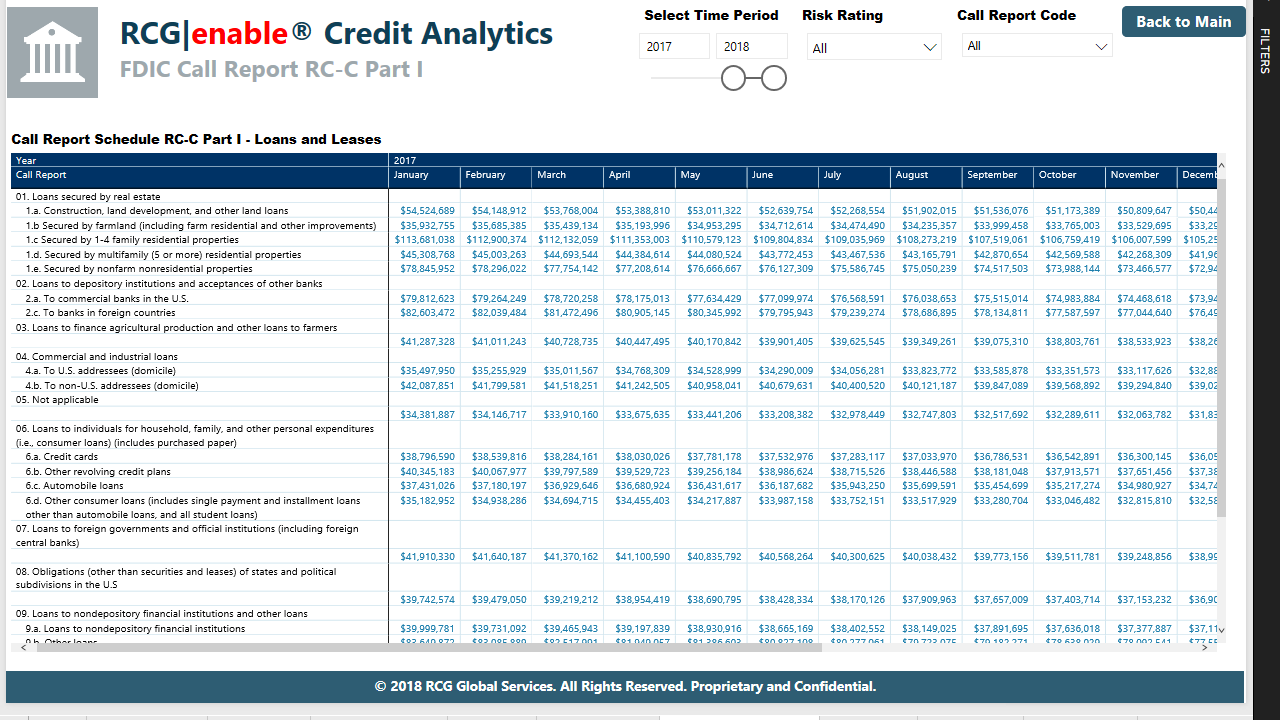

USE CASES / PAIN POINTS Assessing the impact of risk exposures due to: natural events like floods, hurricanes, and tornadoes geographic, business type, and industry concentrations changing economic conditions Also, to manage: portfolio loss and capital reserve requirements FDIC RC-C Part 1 report review and submission

THE SOLUTION RCG|enable® Loan Portfolio Analytics is a solution that is ready for you to use – only your loan data is needed.

TECHNOLOGY RCG Global Services used these technologies to provide a secure, flexible, and expandable data foundation for Credit Analytics and more:

AZURE: an open, flexible, enterprise-grade cloud computing platform for clients to move faster and do more;

CAZENA: provides a secure and automated Cloudera environment that is SOC 2 compliant with end-to-end data encryption and automated maintenance;

CLOUDERA: a software platform for data, machine learning, and analytics that supports all data types widely used in financial services;

TRIFACTA: transforms data preparation – the most time-consuming and inefficient part of any data project.

WHY RCG GLOBAL SERVICES RCG Global Services is a leading provider of world-class technology solutions for complex business initiatives with over 40 years of history in providing ser

商用车自动驾驶主要应用场景包括干线物流、同城物流、矿区物流、港口物流、机场物流等场景。

根据蔚来资本测算,干线物流自动驾驶的潜在空间约为 7,000 亿元,是所有场景中空间最大的市场,其次为同城物流的 2,500 亿元,矿区场景约为 1,700 亿元,港口物流约为 340 亿元。

“类比” 是人类社会与生俱来的本能。

每当遇到新情境时,人类会寻求迅速剥离无关紧要的部分,透过事件表象看本质。这是一种人类无法抑制的心理条件反射。

以 < 图 1 > 代表性产品从上市到发展一亿用户需要多少时间为例,受众会条件反射般认为,ChatGPT 的潜力会比 WeChat、Tiktok、Facebook 大得多。

但实际上,ChatGPT 用户停滞增长许久了(OpenAI 最近又进一步免去用户注册要求,看能否再激活一下增长)。

< 图 2 > 代表性企业在前三年的收入,受众很容易得出结论:OpenAI 的收入变现要比 Google、Amazon、Facebook 好很多。

但实际上,整个生成式 AI 在今年会面临严峻的 “进一步的收入从哪里来的” 问题。而 Google、Amazon、Facebook...

随着 iOS 每个版本的升级,以及开发商资深的功能和管理要求,应用程序的大小正在不断放大。

根据 Sensor Tower 的数据,美国 5 月份下载量排名前 10 的 iPhone 应用程序大小基本是五年前的四倍,需要 2.2 GB 的存储空间(仅应用程序,不包括安装后新产生的内容下载)。

从这个角度也看出网络升级的需求,五年前全球是 4G 网络,现在全球主要也还是 4G 网络。

如果网络不升级,而应用大小增长了四倍,消费者感觉网络变慢也不奇怪了。